Understanding Digital Asset Categories in the Cryptocurrency Ecosystem

The cryptocurrency ecosystem encompasses a diverse range of digital assets, each serving unique purposes and operating under different technical frameworks. This comprehensive educational resource explores the fundamental categories of digital assets, helping learners distinguish between coins and tokens, understand various token types, and grasp the technical specifications that define each category.

The Fundamental Distinction: Coins vs Tokens

Understanding the difference between coins and tokens represents the first essential step in navigating the digital asset landscape. While these terms are often used interchangeably in casual conversation, they describe fundamentally different types of digital assets with distinct technical characteristics and operational frameworks.

Cryptocurrency Coins

Coins operate on their own independent blockchain networks and serve as the native currency of these networks. They function primarily as a medium of exchange, store of value, or unit of account within their respective ecosystems.

- Bitcoin operates on the Bitcoin blockchain

- Ethereum runs on the Ethereum network

- Litecoin functions on its own blockchain

- Used to pay transaction fees on their networks

Digital Tokens

Tokens are built on existing blockchain platforms and represent programmable assets that can serve various functions beyond simple currency. They leverage the security and infrastructure of established networks while providing specialized functionality.

- Built using smart contract standards

- Operate on platforms like Ethereum or Binance Smart Chain

- Can represent various assets or utilities

- Easier and faster to create than new blockchains

The technical distinction between coins and tokens extends beyond their operational framework. Coins require maintaining entire blockchain networks with their own consensus mechanisms, node infrastructure, and security protocols. Tokens, conversely, inherit the security and consensus mechanisms of their host blockchain, allowing developers to focus on specific functionality rather than fundamental blockchain operations.

This architectural difference has significant implications for development complexity, security considerations, and operational costs. Creating a new coin requires substantial technical expertise, ongoing maintenance, and community support to ensure network security and functionality. Token creation, while still requiring technical knowledge, leverages existing infrastructure and can be accomplished more rapidly using standardized smart contract templates.

Utility Tokens: Functional Assets in Decentralized Ecosystems

Utility tokens represent one of the most common and practical categories of digital assets in the cryptocurrency ecosystem. These tokens provide holders with access to specific products, services, or functionalities within a particular blockchain platform or decentralized application. Unlike traditional currencies, utility tokens are designed to facilitate specific operations within their native ecosystems.

Core Characteristics of Utility Tokens

Access Rights

Grant holders permission to use platform features, services, or participate in network activities

Functional Purpose

Designed to perform specific functions within decentralized applications or blockchain networks

Ecosystem Integration

Integral to the operation and economics of their native platforms and applications

Utility tokens serve diverse purposes across different blockchain platforms. In decentralized storage networks, tokens might provide access to storage space or bandwidth. In content platforms, they could enable creators to monetize their work or allow users to access premium content. Gaming platforms use utility tokens for in-game purchases, character upgrades, or participation in special events. Each implementation demonstrates how utility tokens create functional economies within their respective ecosystems.

The value proposition of utility tokens stems from their practical application within specific ecosystems. As platform usage increases, demand for the utility token typically grows, creating a direct relationship between platform success and token utility. This connection distinguishes utility tokens from purely speculative assets, as their value derives from actual usage and functionality rather than solely from market sentiment or trading activity.

Understanding utility tokens requires examining their technical implementation through smart contracts. These contracts define token supply, distribution mechanisms, and the specific utilities the token provides. Smart contracts ensure that token functionality operates automatically and transparently, with all transactions and operations recorded on the blockchain. This programmable nature allows utility tokens to integrate seamlessly with decentralized applications and execute complex operations without intermediaries.

Governance Tokens: Decentralized Decision-Making Mechanisms

Governance tokens represent a revolutionary approach to organizational decision-making in decentralized systems. These digital assets grant holders voting rights and influence over protocol development, parameter adjustments, and strategic decisions within blockchain networks and decentralized autonomous organizations. Governance tokens embody the principle of decentralized control, distributing decision-making power among community members rather than concentrating it in centralized authorities.

Key Functions of Governance Tokens

Proposal Voting

Token holders can vote on protocol upgrades, feature implementations, and strategic initiatives. Voting power typically correlates with the number of tokens held, though some systems implement quadratic voting or other mechanisms to balance influence.

Parameter Adjustment

Governance token holders can modify protocol parameters such as transaction fees, reward rates, collateral requirements, or other operational variables that affect network functionality and economics.

Treasury Management

Many protocols maintain community treasuries funded by protocol fees or token allocations. Governance token holders decide how these funds are allocated, whether for development grants, marketing initiatives, or ecosystem growth.

Protocol Evolution

Token holders guide the long-term direction of protocols, voting on major upgrades, integration with other platforms, or fundamental changes to the protocol's architecture and functionality.

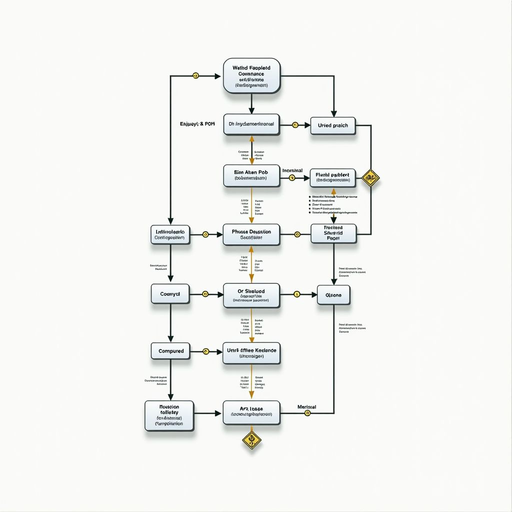

The governance process typically follows a structured framework. Community members submit proposals detailing suggested changes, improvements, or initiatives. These proposals undergo discussion periods where stakeholders debate merits, potential impacts, and implementation details. Following discussion, proposals move to formal voting periods where governance token holders cast their votes. Successful proposals that meet quorum requirements and achieve necessary approval thresholds proceed to implementation.

Governance tokens introduce complex considerations regarding participation, representation, and decision quality. Token concentration among large holders can lead to governance centralization, potentially undermining decentralization goals. Some protocols implement delegation mechanisms allowing token holders to delegate voting power to trusted representatives, increasing participation while maintaining individual control. Others experiment with time-weighted voting, reputation systems, or conviction voting to balance different stakeholder interests and encourage thoughtful participation.

The technical implementation of governance tokens involves sophisticated smart contract systems that manage proposal submission, voting mechanics, vote counting, and execution of approved changes. These systems must ensure security, prevent manipulation, and provide transparency while remaining accessible to diverse participants. Understanding governance tokens requires appreciating both their technical architecture and their role in creating decentralized, community-driven organizations that operate without traditional hierarchical structures.

Non-Fungible Tokens and Technical Standards

Non-fungible tokens represent a distinct category of digital assets characterized by their uniqueness and indivisibility. Unlike fungible tokens where each unit is identical and interchangeable, NFTs possess unique identifiers and metadata that distinguish each token from all others. This fundamental property enables NFTs to represent ownership of specific digital or physical items, creating verifiable scarcity and provenance in the digital realm.

Understanding Token Standards

ERC-721: The Original NFT Standard

The ERC-721 standard, introduced on the Ethereum blockchain, established the foundational framework for non-fungible tokens. This standard defines a minimum interface that smart contracts must implement to create, transfer, and manage unique tokens. Each ERC-721 token contains a unique identifier (tokenId) that distinguishes it from all other tokens in the contract, along with metadata that describes the token's properties and characteristics.

Key Features:Unique token identification, ownership tracking, transfer mechanisms, approval systems for third-party transfers, and metadata URI for storing token information.

ERC-1155: Multi-Token Standard

The ERC-1155 standard represents an evolution in token design, enabling a single smart contract to manage multiple token types simultaneously. This standard supports both fungible and non-fungible tokens within the same contract, offering significant efficiency improvements for applications requiring diverse token types. Gaming platforms particularly benefit from ERC-1155, as they can manage currencies, items, and unique collectibles through a unified interface.

Advantages:Reduced gas costs through batch operations, flexible token types within single contracts, efficient transfers of multiple tokens, and simplified smart contract management.

ERC-20: Fungible Token Standard

While not an NFT standard, ERC-20 deserves mention as the most widely adopted standard for fungible tokens on Ethereum. ERC-20 tokens are identical and interchangeable, making them suitable for currencies, utility tokens, and governance tokens. The standard defines functions for transferring tokens, checking balances, and approving third-party spending, creating a consistent interface that wallets and exchanges can easily integrate.

Common Uses:Cryptocurrency tokens, platform utility tokens, governance tokens, stablecoins, and reward tokens in decentralized applications.

NFT applications extend far beyond digital art and collectibles. These tokens enable representation of real-world assets, intellectual property rights, event tickets, domain names, and identity credentials. In gaming, NFTs represent unique items, characters, or virtual real estate that players truly own and can trade freely. Supply chain applications use NFTs to track product authenticity and provenance. Real estate platforms explore NFT-based property ownership and fractional ownership models.

The technical architecture of NFTs involves smart contracts that store token identifiers and ownership records on-chain, while metadata and associated content often reside off-chain due to blockchain storage limitations. Metadata typically includes descriptions, attributes, and links to media files stored on decentralized storage systems or traditional servers. This hybrid approach balances blockchain immutability with practical storage considerations, though it introduces dependencies on external systems for accessing complete token information.

Understanding token standards proves essential for anyone working with digital assets. These standards ensure interoperability between different platforms, wallets, and applications, creating a cohesive ecosystem where tokens can move freely and function consistently. As the blockchain space evolves, new standards emerge to address specific use cases, improve efficiency, or enable novel functionality, continuing the evolution of digital asset infrastructure.

Practical Applications Across Digital Asset Categories

The diverse categories of digital assets enable a wide range of practical applications across industries and use cases. Understanding how different asset types function in real-world scenarios helps learners appreciate the practical implications of technical distinctions and recognize opportunities for blockchain technology to solve existing problems or create new possibilities.

Gaming and Virtual Worlds

NFTs represent in-game items, characters, and virtual land. Utility tokens facilitate in-game economies and transactions. Governance tokens allow players to influence game development and rule changes, creating player-owned gaming ecosystems.

Digital Art and Collectibles

NFTs enable artists to tokenize digital artwork, establishing provenance and enabling direct sales to collectors. Smart contracts can include royalty mechanisms ensuring artists receive compensation from secondary sales, creating sustainable creator economies.

Decentralized Finance

Governance tokens enable community control of DeFi protocols. Utility tokens provide access to lending, borrowing, and trading services. Stablecoins function as digital currencies maintaining value stability for transactions and savings.

Identity and Credentials

NFTs represent verifiable credentials, certifications, and identity documents. Soulbound tokens create non-transferable reputation systems. These applications enable portable, verifiable digital identities controlled by individuals rather than centralized authorities.

Real Estate and Property

NFTs tokenize real estate ownership, enabling fractional ownership and simplified transfers. Smart contracts automate rental agreements and property management. Blockchain-based property records provide transparent, immutable ownership history.

Supply Chain Management

NFTs track product authenticity and movement through supply chains. Each item receives a unique token recording its origin, handling, and ownership history. This transparency helps combat counterfeiting and ensures product quality.

These applications demonstrate how different digital asset categories address specific needs and create value in diverse contexts. Utility tokens excel in creating functional economies within platforms, governance tokens enable decentralized decision-making, and NFTs provide verifiable uniqueness and ownership. Understanding these distinctions helps learners recognize appropriate applications for different asset types and appreciate the versatility of blockchain technology.

The evolution of digital assets continues as developers experiment with new token designs, standards, and applications. Hybrid tokens combining multiple characteristics, dynamic NFTs that change based on external conditions, and novel governance mechanisms represent ongoing innovation in the space. As blockchain technology matures and adoption grows, digital assets will likely find applications in additional industries and use cases, further expanding the ecosystem and creating new opportunities for value creation and exchange.

Continuing Your Learning Journey

Understanding digital asset categories provides a foundation for exploring the broader cryptocurrency ecosystem. This knowledge enables learners to evaluate projects, understand technical documentation, and recognize how different assets function within decentralized systems. As you continue learning, consider exploring specific token standards in depth, examining real-world implementations, and staying current with emerging developments in digital asset design and application.